5 Percent Deposit

Chancellor Rishi Sunak has today (3 March) announced a new five per cent deposit mortgage scheme in the Budget.

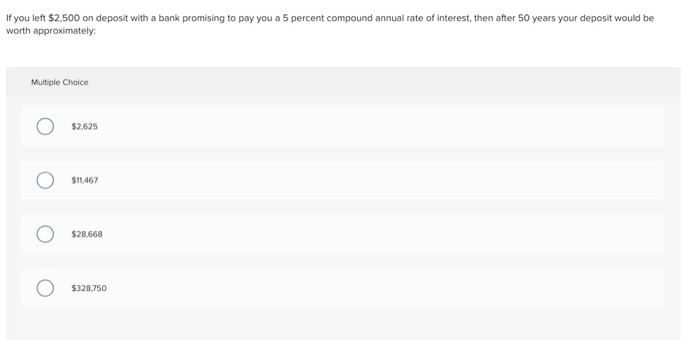

If you put down 10% ($20,000 on the average home) or 5% ($10,000 on the average home), then you will be able to become a homeowner faster, since you won’t have to save as much cash. The concept works on a larger scale as well. If you have $5,000 to invest right now and believe that you can add $200 monthly over the next 25 years, you will have invested $65,000. Thanks to the magic of 5 percent interest, your savings will be over $131,000. What Is Interest? Given the above, interest may seem like wizardry. A low deposit home loan generally means a home loan where the lender will accept a deposit which is worth less than 20% of the total loan amount. This is just a ballpark figure, but it’s widely accepted that anything between a 5% and 20% deposit is considered a ‘low deposit’. A mortgage guarantee scheme to encourage home ownership and help buyers with deposits of just 5 per cent to get on to the property ladder, is due to be announced when Chancellor Rishi Sunak. The mortgage you get is for 75% of the LTV of the house. 20% is taken from an equity loan, with the final 5% taken from your deposit. In London, the 20% equity loan be as high as 40%, so you’d get a 55% mortgage. The equity loan is the special part of the Help to Buy scheme. You don’t pay any interest or fees on it for the first five years.

The scheme will be available to both first-time buyers and current homeowners looking to buy a house for up to £600,000.

How does the scheme work?

The new ‘mortgage guarantee’ will be available to lenders from April and is designed to help buyers who cannot afford a large deposit to get onto the property ladder.

Under the scheme, the government will offer to take on some of the risk of low deposit loans, meaning lenders will have some protection from potential losses.

Low deposit loans are often regarded as higher risk as borrowers could end up in negative equity if house prices fall, leaving them owing more than their property is worth.

Lenders will now be able to purchase a government guarantee that compensates them for a portion of their losses in the event of foreclosure.

All lenders under the scheme will offer mortgages that are fixed for at least five years as part of their range of products, providing options for those with smaller deposits who want the security and predictability of a mortgage with a fixed rate over a longer term.

Announcing the mortgage deposit scheme, Mr Sunak said: “Lenders who provide mortgages to homebuyers who can only afford a five per cent deposit will benefit from a government guarantee on those mortgages.

“I’m pleased to say that several of the country’s largest lenders including Lloyds, NatWest, Santander, Barclays and HSBC will be offering these 95 per cent mortgages from next month, and I know more, including Virgin Money will follow shortly after.

“A policy that gives people who can’t afford a big deposit the chance to buy their own home. As the Prime Minister has said, we want to turn generation rent into generation buy.”

Prime Minister Boris Johnson has said previously that he wants to turn a generation of renters into a generation of buyers and “these 95 per cent mortgage guarantees help to deliver this promise.

Mr Sunak added: “By giving lenders the option of a government guarantee on 95 per cent mortgages, many more products will become available, helping people to achieve their dream and get on the housing ladder.”

Help to get on the property ladder

5 Percent Deposit Scheme

The new initiative follows in the footsteps of the UK-wide Help to Buy mortgage guarantee scheme, which was launched in 2013 and helped to reinvigorate the market after the 2008 financial crisis.

5 Percent Deposit Mortgage

This scheme also offered five per cent deposit mortgages, and helped more than 100,000 people across the UK to buy a home, but it is no longer running.

The introduction of this new low mortgage deposit scheme marks a positive step for the property sector, after many low deposit mortgages vanished from the market last year amid concerns about the wider economy.

However, more recently, lenders have been bringing back low deposit deals, clustered around the 10 per cent deposit mark.

Yorkshire Building Society launched two new 10 per cent mortgages on Wednesday (3 March) exclusively for first-time buyers.

House prices have also jumped to record highs in recent months, which has been partially fuelled by the temporary stamp duty holiday. This was due to end on 31 march, but has now been extended to 30 June.

In response to the five per cent deposit mortgage scheme, Islay Robinson, CEO of Enness Global Mortgages, said: “Ninety five per cent mortgage products in any shape or form take the market into pretty overheated, dangerous territory and we’ve previously seen the results of this kind of precarious lending to those who aren’t really in the financial position to commit to it.

“As always, the devil will be in the detail but many lenders have already tightened their belts over the last few months in terms of their high loan to value offerings.

“Although many big lenders have committed to the government’s announcement today, it will be interesting to see just how many buyers are able to secure such a product when it comes to actually applying.

“Converting Generation Rent to Generation Buy is a noble initiative but not if it comes at the expense of wider market health.”

Keith Richards, chief executive of the Personal Finance Society, added: “The extension of the stamp duty holiday and mortgage guarantee scheme to help first-time buyers and current homeowners with just five per cent deposits to buy properties worth up to £600,000 are welcome short-term fixes but to truly turn Generation Rent into Generation Buy then long-term action is needed.

5 Percent Deposit

“The damage done to personal finances by Covid-19 means the mortgage guarantee scheme will be welcomed by those whose ability to set cash aside for a deposit to get onto the housing ladder has been hampered by furlough, but what we need to turn the tide on home ownership in the UK is more affordable housing.”